Essay

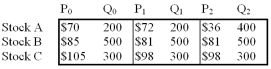

-Based on the information given,for a price-weighted index of the three stocks calculate:

a.the rate of return for the first period (t = 0 to t = 1).

b.the value of the divisor in the second period (t=2).Assume that Stock A had a 2-1 split during this period.

c.the rate of return for the second period (t = 1 to t = 2).

Correct Answer:

Verified

A. The price-weighted index at time 0 is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: A US dollar denominated bond that is

Q53: Consider the following three stocks:

Q54: For a taxpayer in the 15% marginal

Q56: A bond that can be retired prior

Q58: Federally sponsored agency debt<br>A)is legally insured by

Q60: For a taxpayer in the 25% marginal

Q61: Unsecured bonds are called _.<br>A)junk bonds<br>B)debentures<br>C)indentures<br>D)subordinated debentures<br>E)either

Q85: Commercial paper is a short-term security issued

Q86: The largest component of the money market

Q87: Which of the following securities is a