Multiple Choice

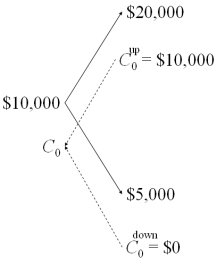

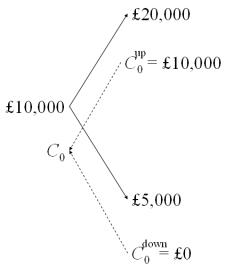

Draw the tree for a call option on $20,000 with a strike price of £10,000.The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half.The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Calculate the current €/£ spot exchange rate.

Q21: What paradigm is used to define the

Q24: An "option" is<br>A)a contract giving the seller

Q31: Consider the graph of a call option

Q46: Find the dollar value today of a

Q54: Verify that the dollar value of your

Q67: USING RISK NEUTRAL VALUATION find the value

Q76: Today's settlement price on a Chicago Mercantile

Q93: State the composition of the replicating portfolio;

Q98: USING RISK NEUTRAL VALUATION (i.e. the binomial