Multiple Choice

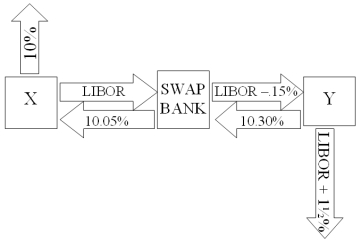

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below: A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 10.05%.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

A) The swap bank will earn 40 basis points per year on $10,000,000 = $40,000 per year.

B) The swap bank will earn 10 basis points per year on $10,000,000 = $10,000 per year.

C) The swap bank will LOSE money.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Explain how firm A could use two

Q58: The size of the swap market is<br>A)measured

Q72: With regard to a swap bank acting

Q75: Come up with a swap (exchange

Q76: Suppose that you are a swap

Q78: Company X wants to borrow $10,000,000

Q83: A is a U.S.-based MNC with

Q84: Explain how firm B could use the

Q84: Use the following information to calculate

Q85: Suppose that you are a swap