Multiple Choice

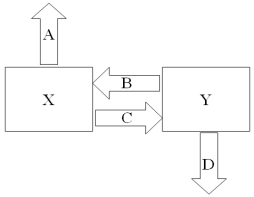

Company X wants to borrow $10,000,000 floating for 5 years.Company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are: Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

A) A = 10%; B = 11.75%; C = LIBOR - .25%; D = LIBOR + 1.5%

B) A = 10%; B = 10%; C = LIBOR - .25%; D = LIBOR + 1.5%

C) A = LIBOR; B = 10%; C = LIBOR - .25%; D = 12%

D) A = LIBOR; B = LIBOR; C = LIBOR - .25%; D = 12%

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A swap bank has identified two companies

Q14: When a swap bank serves as a

Q26: Devise a direct swap for A and

Q28: Show how your proposed swap would work

Q61: A major risk faced by a swap

Q75: Explain how firm A could use the

Q80: Swaps are said to offer market completeness<br>A)This

Q84: Explain how firm B could use the

Q88: Suppose that the swap that you proposed

Q90: Explain how this opportunity affects which swap