Multiple Choice

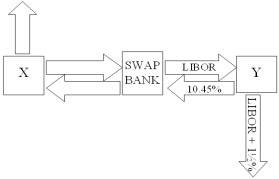

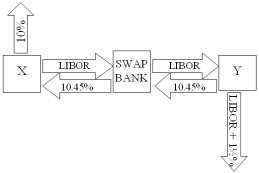

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below: A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume company Y has agreed,but company X will only agree to the swap if the bank offers better terms.

What are the absolute best terms the bank can offer X,given that it already booked Y?

A) 10.45%-10.45% against LIBOR flat.

B) 10.45%-10.05% against LIBOR flat.

C) 10.50%-10.50% against LIBOR flat

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Explain how firm B could use the

Q13: Act as a swap bank and quote

Q14: Company X wants to borrow $10,000,000

Q15: Company X wants to borrow $10,000,000

Q16: Company X wants to borrow $10,000,000

Q31: Suppose the quote for a five-year swap

Q36: When a swap bank serves as a

Q38: In the swap market, which position potentially

Q60: Explain how this opportunity affects which swap

Q82: When an interest-only swap is established on