Essay

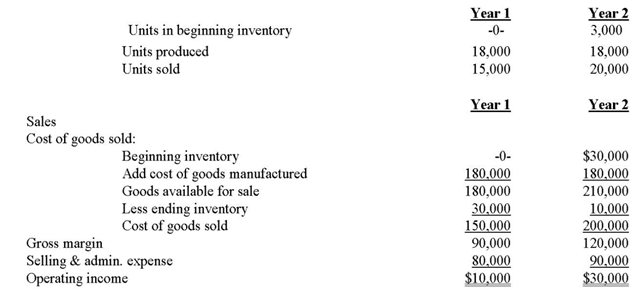

Operating data for Fowler Company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses were $2 per unit sold.

Required:

a) What was the unit product cost in each year under variable costing?

b) Prepare new income statements for each year using variable costing.

c) Reconcile the absorption costing and variable costing operating income for each year.

Correct Answer:

Verified

a) The manufacturing cost of $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Jarvix Company, which has only

Q50: Chown Company, which has only

Q60: The term "gross margin" for a manufacturing

Q62: During the most recent year,Evans Company had

Q65: Last year, Walsh Company manufactured

Q77: Jarvix Company, which has only

Q78: Last year, Walsh Company manufactured

Q87: Last year, Harris Company manufactured

Q104: Farron Company, which has only one

Q110: Operating income determined using absorption costing can