Essay

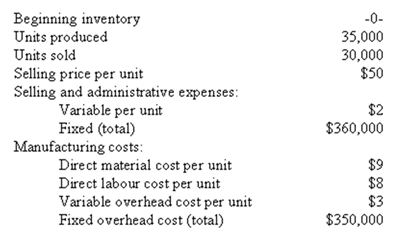

UHF Antennas,Inc.,produces and sells a unique television antenna.The company has just opened a new plant to manufacture the antenna,and the following cost and revenue data have been reported for the first month of the new plant's operation:

Management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month. Assume that direct labour is a variable cost.

Required:

a) Assuming that the company uses absorption costing, compute the unit product cost and prepare an income statement.

b) Assuming that the company uses variable costing, compute the unit product cost and prepare an income statement.

c) Explain the reason for any difference in the ending inventories under the two costing methods and the impact of this difference on reported operating income.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Aaker Company, which has only

Q14: For the most recent year,Atlantic Company's operating

Q15: Absorption costing treats fixed manufacturing overhead as

Q47: What is the costing method that can

Q68: Khanam Company, which has only

Q88: Farron Company, which has only one

Q102: Which of the following are considered to

Q120: Hatfield Company, which has only

Q130: Khanam Company, which has only

Q142: Farron Company, which has only one