Essay

The Great Toy Company (GTC) produces a radio-controlled toy that it wholesales to retailers. For the month of September 2008, GTC reported a before-tax profit of $4,400 when it produced and sold 7,500 units of the toy.

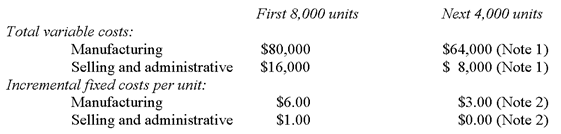

GTC's controller has provided the following information about the company's cost structure:

Note 1: These are additional total variable costs to produce (sell) the additional 4,000 units.

Note 2: Each is calculated as additional fixed cost divided by the 4,000 additional units.

The marketing manager states that the average selling price per unit for the 7,500 units that were sold in September 2008 is valid for the first 8,000 units. She, however, estimates that the average unit selling price for the additional 4,000 units will be 7.5% lower.

Required:

a. Calculate the following for the two levels of production and sales:

(i) Average variable manufacturing cost per unit

(ii) Average selling and administrative cost per unit

(iii) Total fixed manufacturing cost

(iv) Total fixed selling and administrative cost

b. Using the contribution margin format, prepare the following:

(i). An income statement for month ended September 30, 2008 when GTC produced and sold 7,500 units.

(ii). Prepare a contribution for the month when GTC expects to produce and sell 12,000 units.

Correct Answer:

Verified

a.

(i) Average variable manufacturing c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(i) Average variable manufacturing c...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The high-low method is generally less accurate

Q9: Wilson Company's activity for the

Q12: Mateo Company's average cost per unit is

Q21: Suppose Y Company uses ABC for internal

Q27: Sorter Company has provided the

Q59: Which of the following is an example

Q77: Given the cost formula Y = $15,000

Q94: Because the least-squares regression method is more

Q97: Maxwell Company has a total expense

Q110: A cost that is obtainable in large