Essay

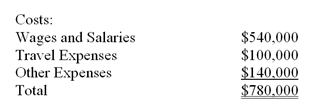

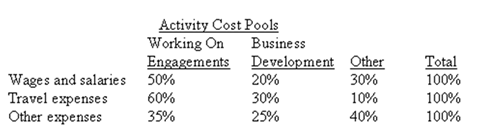

Fife & Jones PLC,a consulting firm,uses an activity-based costing in which there are three activity cost pools.The company has provided the following data concerning its costs and its activity-based costing system:

Distribution of Resource Consumption:

Required:

a) How much cost, in total, would be allocated to the Working On Engagements activity cost pool?

b) How much cost, in total, would be allocated to the Business Development activity cost pool?

c) How much cost, in total, would be allocated to the Other activity cost pool?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following statements about overhead

Q6: (Appendix 5A)Which of the following best describes

Q7: Goel Company,a wholesale distributor,uses activity-based costing for

Q10: Jackson Painting paints the interiors and exteriors

Q11: Diehl Company uses an activity-based costing system

Q29: Managing and sustaining product diversity requires many

Q35: Groce Catering uses activity-based costing

Q116: Organization-sustaining activities are carried out regardless of

Q118: In the second-stage allocation in activity-based costing,activity

Q121: Which of the following is NOT a