Essay

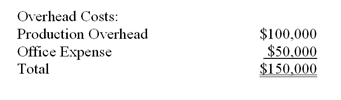

Phoenix Company makes custom covers for air conditioning units for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

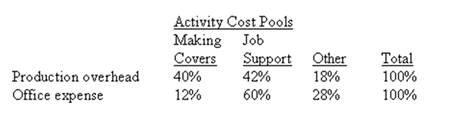

Distribution of Resource Consumption:

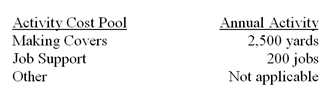

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

Required:

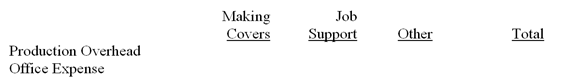

a) Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

b) Compute the activity rates (i.e., cost per unit of activity) for the Making Covers and Job Support activity cost pools by filling in the table below:

c) (Appendix 5A) Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labour cost of $1,500. The sales revenue from this job is $2,500. For purposes of this action analysis report, direct materials and direct labour should be classified as a Green cost, production overhead as a Red cost, and office expense as a Yellow cost.

Correct Answer:

Verified

a) First-s...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Activity rates in activity-based costing are computed

Q17: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1327/.jpg" alt=" -What would be

Q20: Grodt Catering uses activity-based costing

Q48: The first-stage allocation in activity-based costing is

Q76: Diehl Company uses an activity-based

Q95: Arthur Company has two products: S and

Q96: (Appendix 5A)Which of the following statements concerning

Q97: Accola Company uses activity-based costing. The company

Q101: Which of the following is the fundamental

Q115: Abel Company uses activity-based costing.