Essay

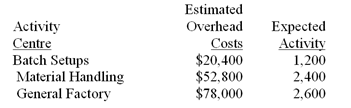

Eaker Company uses activity-based costing to compute product costs for external reports.The company has three activity cost pools and applies overhead using predetermined overhead rates for each activity cost pool.Estimated costs and activities for the current year are presented below for the three activity centres:

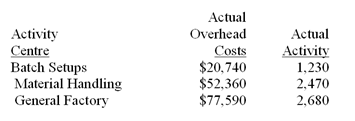

Actual costs and activities for the current year were as follows:

Required:

a) How much total overhead was applied to products during the year?

b) By how much was overhead overapplied or underapplied? (Be sure to clearly label your answer as to whether the overhead was overapplied or underapplied for each activity centre as well as for the total.)

Correct Answer:

Verified

a) The overhead rates for each activity ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Monson Company has two products:

Q60: Monson Company has two products: G and

Q64: Daba Company manufactures two products,Product F and

Q64: Changing a cost accounting system is likely

Q66: (Appendix 5B)Werger Manufacturing Corporation has a traditional

Q67: Addy Company has two products: A and

Q72: Which of the following activity levels is

Q80: Which of the following types of costs

Q98: Foster Florist specializes in large floral

Q100: Activity-based costing is a costing method that