Multiple Choice

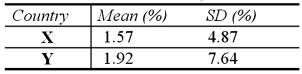

The mean and standard deviation (SD) of monthly returns, over a given period of time, for the stock markets of two countries, X and Y are  Assuming that the monthly risk-free interest rate is 0.25%, the Sharpe performance measures, SHP(X) and SHP(Y) , and the performance ranks, respectively, for X and Y are:

Assuming that the monthly risk-free interest rate is 0.25%, the Sharpe performance measures, SHP(X) and SHP(Y) , and the performance ranks, respectively, for X and Y are:

A) SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B) SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C) SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D) SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

Correct Answer:

Verified

Correct Answer:

Verified

Q23: The less correlated the securities in a

Q54: Exchange rate fluctuations contribute to the risk

Q86: Explanations for Home Bias include<br>A)domestic securities may

Q87: Advantages of investing in U.S.-based international mutual

Q88: Hedge funds<br>A)do not register as an investment

Q89: The stock market of country A has

Q91: Emerald Energy is an oil exploration and

Q93: If the investor hedges the exchange rate

Q94: Calculate the euro-based return an Italian investor

Q95: Calculate the euro-based return an Italian investor