Multiple Choice

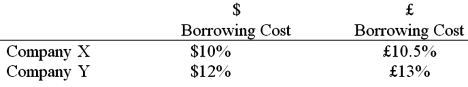

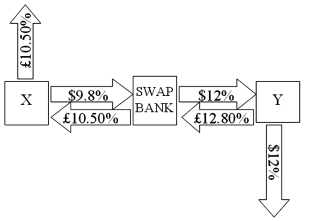

Company X wants to borrow $10,000,000 for 5 years; company Y wants to borrow £5,000,000 for 5 years. The exchange rate is $2 = £1 and is not expected to change over the next 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

A) The swap bank will earn 10 basis points per year; the only risk is default risk.

B) The swap bank will earn 10 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk.

C) The swap bank will earn 10 basis points per year but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk.

D) The swap bank will earn 20 basis points per year in dollars but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What would be the interest rate?

Q2: What would be the interest rate?

Q60: Explain how this opportunity affects which swap

Q80: Swaps are said to offer market completeness<br>A)This

Q82: When an interest-only swap is established on

Q84: Explain how firm B could use the

Q86: Suppose the quote for a five-year swap

Q87: Consider a plain vanilla interest rate swap.

Q88: Suppose that the swap that you proposed

Q90: Explain how this opportunity affects which swap