Multiple Choice

A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00, a swap bank makes the following quotes for 1-year swaps and AAA-rated firms against USD LIBOR:  The firms external borrowing opportunities are:

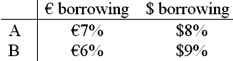

The firms external borrowing opportunities are:

A) Firm A does 2 swaps with the swap bank, $ at bid and € at ask. Firm B does 2 swaps with the swap bank, $ at ask and € at bid. Firms A and B would each save 90bp and the swap bank would earn 20bp.

B) There is no mutually beneficial swap at these prices.

C) Firm A does 2 swaps with the swap bank, $ at ask and € at bid. Firm B does 2 swaps with the swap bank, $ at bid and € at ask. Firms A and B would each save 90bp and the swap bank would earn 20bp.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What would be the interest rate?

Q60: Explain how this opportunity affects which swap

Q74: Company X wants to borrow $10,000,000 floating

Q75: Explain how firm A could use the

Q76: In an interest-only currency swap<br>A)the counterparties must

Q77: Company X and company Y have mirror-image

Q78: Suppose ABC Investment Banker Ltd., is quoting

Q80: Swaps are said to offer market completeness<br>A)This

Q82: When an interest-only swap is established on

Q84: Explain how firm B could use the