Multiple Choice

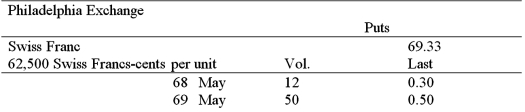

In the CURRENCY TRADING section of The Wall Street Journal, the following appeared under the heading OPTIONS:  Which combination of the following statements are true? (i) - The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.

Which combination of the following statements are true? (i) - The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.

(ii) - The 68 May put option has a lower time value (price) than the 69 May put option.

(iii) - If everything else is kept constant, the spot price and the put premium are inversely related.

(iv) - The time values of the 68 May and 69 May put options are, respectively, 1.63 cents and 0.83 cents.

(v) - If everything else is kept constant, the strike price and the put premium are inversely related.

A) (i) , (ii) , and (iii)

B) (ii) , (iii) , and (iv)

C) (iii) and (iv)

D) (iv) and (v)

Correct Answer:

Verified

Correct Answer:

Verified

Q50: A put option on $15,000 with a

Q72: The hedge ratio<br>A)Is the size of the

Q73: For European currency options written on euro

Q74: If the call finishes out-of-the-money what is

Q75: Which of the following is correct?<br>A)European options

Q76: Today's settlement price on a Chicago Mercantile

Q79: From the perspective of the writer of

Q80: The current spot exchange rate is $1.55

Q81: Open interest in currency futures contracts<br>A)tends to

Q82: For European options, what of the effect