Multiple Choice

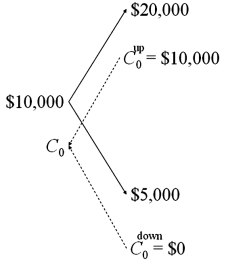

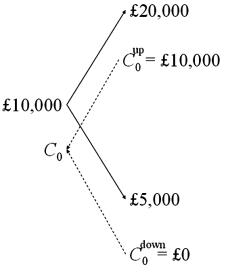

Draw the tree for a call option on $20,000 with a strike price of £10,000. The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q21: What paradigm is used to define the

Q28: Find the input d<sub>1</sub> of the Black-Scholes

Q30: If the call finishes in-the-money what is

Q31: The volume of OTC currency options trading

Q32: Which of the follow options strategies are

Q36: Find the value of a one-year put

Q37: With currency futures options the underlying asset

Q38: Find the value of a one-year call

Q48: Yesterday,you entered into a futures contract to

Q74: Exercise of a currency futures option results