Multiple Choice

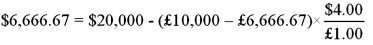

Value a 1-year call option written on £10,000 with an exercise price of $2.00 = £1.00. The spot exchange rate is $2.00 = £1.00; The U.S. risk-free rate is 5% and the U.K. risk-free rate is also 5%. In the next year, the pound will either double in dollar terms or fall by half (i.e. u = 2 and d = ½) . Hint: H = ⅔.

A) $6,349.21

B)

C)

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q44: An investor believes that the price of

Q49: Draw the binomial tree for this option.

Q50: If the call finishes in-the-money what is

Q51: Three days ago, you entered into a

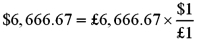

Q53: Consider a 1-year call option written on

Q54: Verify that the dollar value of your

Q57: For European options, what of the effect

Q69: If a currency futures contract (direct quote)is

Q86: Find the risk neutral probability of an

Q96: Use your results from the last three