Multiple Choice

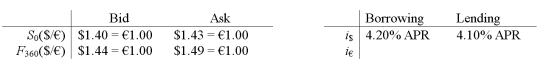

How high does the lending rate in the euro zone have to be before an arbitrageur would NOT consider borrowing dollars, trading for euro at the spot, investing in the euro zone and hedging with a short position in the forward contract?

A) The bid-ask spreads are too wide for any profitable arbitrage when i€ > 0

B) 3.48%

C) -2.09%

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q20: According to the monetary approach, the exchange

Q21: As of today, the spot exchange rate

Q22: With regard to fundamental forecasting versus technical

Q24: If you had borrowed $1,000,000 and traded

Q24: If you had borrowed $1,000,000 and traded

Q28: USING YOUR PREVIOUS ANSWERS and a bit

Q29: A higher U.S. interest rate (i<sub>$</sub> ↑)

Q30: The moving average crossover rule<br>A)is a fundamental

Q39: There is (at least) one profitable arbitrage

Q61: If you borrowed €1,000,000 for one year,