Multiple Choice

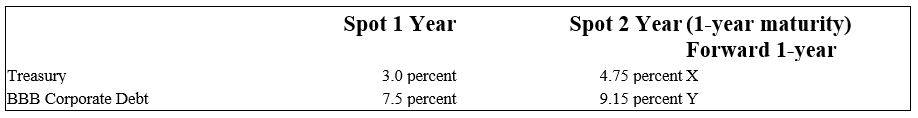

The following is information on current spot and forward term structures (assume the corporate debt pays interest annually) :

-The duration of a soon to be approved loan of $10 million is four years.The 99th percentile increase in risk premium for bonds belonging to the same risk category of the loan has been estimated to be 5.5 percent. If the fee income on this loan is 0.4 percent and the spread over the cost of funds to the bank is 1 percent,what is the expected income on this loan for the current year?

A) $40,000.

B) $100,000.

C) $140,000.

D) $180,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Which of the following is NOT characteristic

Q36: At some point, further increases in interest

Q57: Commercial paper has become an acceptable substitute

Q58: The probability that a borrower would default

Q98: Long-term loans are more likely to be

Q105: Credit rationing by an FI<br>A)involves restricting the

Q106: The following is information on current spot

Q109: The following is information on current spot

Q111: Which of the following observations concerning floating-rate

Q113: Which of the following is NOT characteristic