Multiple Choice

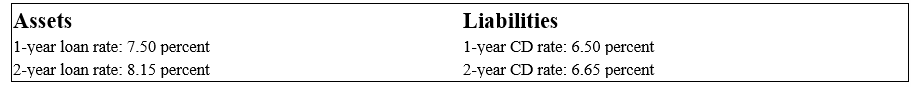

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-If interest rates increase by 20 basis points (i.e. , R = 20 basis points) ,use the duration approximation to determine the approximate price change for the Treasury note.

A) $0.000.

B) $0.2775 per $100 face value.

C) $2.775 per $100 face value.

D) $0.2672 per $100 face value.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Using a fixed-rate bond to immunize a

Q66: A key assumption of Macaulay duration is

Q81: The larger the size of an FI,the

Q82: The numbers provided are in millions of

Q84: Calculating modified duration involves<br>A)dividing the value of

Q85: What is the effect of a 100

Q88: If all interest rates decline 90

Q89: First Duration Bank has the following assets

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1314/.jpg" alt=" -Calculate the duration

Q115: Buying a fixed-rate asset whose duration is