Multiple Choice

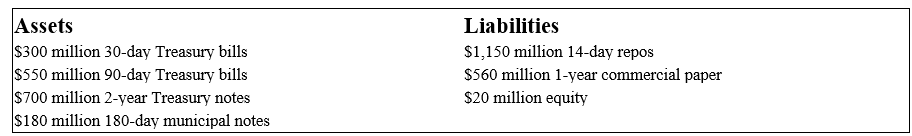

Third Duration Investments has the following assets and liabilities on its balance sheet. The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year.

-What is the leverage-adjusted duration gap?

A) 0.605 years.

B) 0.956 years.

C) 0.360 years.

D) 0.436 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Marking-to-market accounting is a market value accounting

Q11: The immunization of a portfolio against interest

Q30: An FI purchases a $9.982 million pool

Q31: Duration is equal to maturity when at

Q33: A bond is scheduled to mature in

Q33: The following information is about current spot

Q34: Third Duration Investments has the following assets

Q35: The shortcomings of this strategy are the

Q36: The numbers provided are in millions of

Q83: Duration of a fixed-rate coupon bond will