Multiple Choice

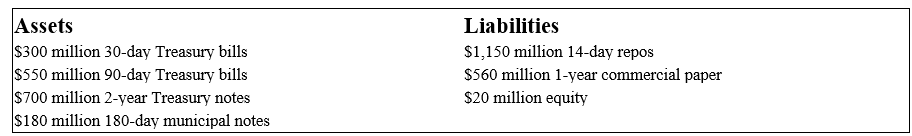

Third Duration Investments has the following assets and liabilities on its balance sheet. The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year.

-If interest rates increase by 20 basis points,what is the approximate change in the market price using the duration approximation?

A) -$7.985

B) -$7.941

C) -$3.990

D) +$3.990

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The duration of all floating rate debt

Q13: The numbers provided by Fourth Bank of

Q16: An FI has financial assets of $800

Q17: Investing in a zero-coupon asset with a

Q18: Third Duration Investments has the following assets

Q25: All fixed-income assets exhibit convexity in their

Q48: Deep discount bonds are semi-annual fixed-rate coupon

Q73: Convexity is a desirable effect to a

Q75: Larger coupon payments on a fixed-income asset

Q81: Duration considers the timing of all the