Multiple Choice

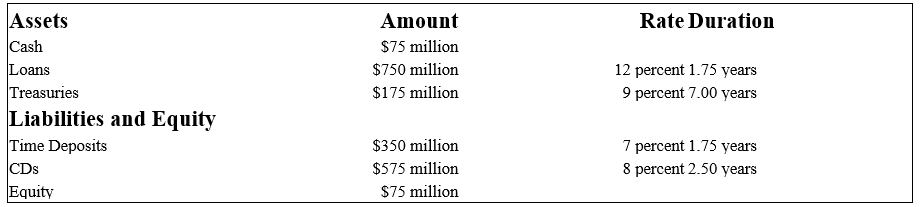

-Calculate the leverage-adjusted duration gap to four decimal places and state the FI's interest rate risk exposure of this institution.

A) +1.0308 years;exposed to interest rate increases.

B) -0.3232 years;exposed to interest rate increases.

C) +0.8666 years;exposed to interest rate increases.

D) +0.4875 years;exposed to interest rate increases.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Immunization of an FIs net worth requires

Q5: The duration of a consol bond is<br>A)less

Q7: Immunizing the balance sheet to protect equity

Q10: The duration of all floating rate debt

Q12: An FI can immunize its portfolio by

Q13: The numbers provided by Fourth Bank of

Q17: Investing in a zero-coupon asset with a

Q48: Deep discount bonds are semi-annual fixed-rate coupon

Q75: Larger coupon payments on a fixed-income asset

Q125: Normally, duration is less than the maturity