Multiple Choice

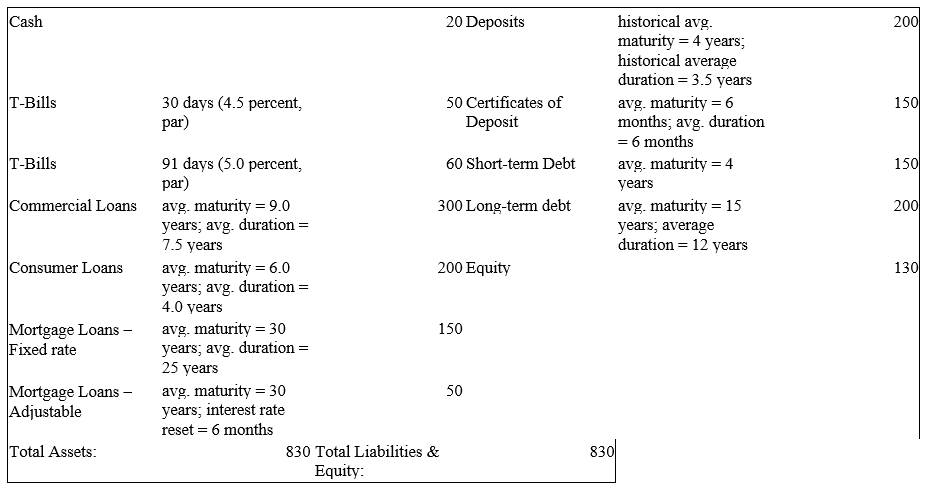

The numbers provided are in millions of dollars and reflect market values:

-A risk manager could restructure assets and liabilities to reduce interest rate exposure for this example by

A) increasing the average duration of its assets to 9.56 years.

B) decreasing the average duration of its assets to 4.00 years.

C) increasing the average duration of its liabilities to 6.78 years.

D) increasing the average duration of its liabilities to 9.782 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: A bond is scheduled to mature in

Q65: Matching the maturities of assets and liabilities

Q68: Duration is related to maturity in a

Q70: An FI purchases at par value a

Q71: A $1,000 six-year Eurobond has an 8

Q75: What is the duration of a 5-year

Q76: The numbers provided are in millions of

Q77: All else equal,as compared to an annual

Q79: What conclusions can you draw from the

Q130: The greater is convexity, the more insurance