Multiple Choice

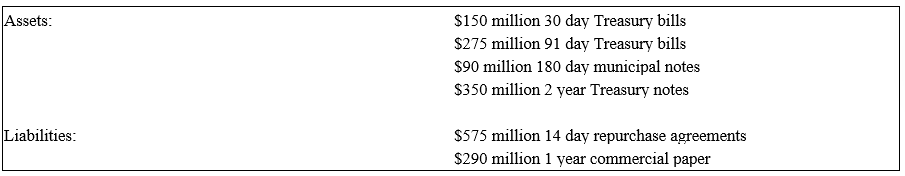

The following are the assets and liabilities of a government security dealer.

-Use the repricing model to determine the funding gap for a maturity bucket of 30 days.

A) -$425 million.

B) -$95 million.

C) -$10 million.

D) -$475 million.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: If the average maturity of assets is

Q12: Which of the following indicates a positive

Q13: An increase in interest rates<br>A)increases the market

Q18: The following is the balance sheet of

Q20: The following information is from First Yaupon

Q22: The balance sheet of XYZ Bank appears

Q48: Because of its complexity, small depository institutions

Q74: If interest rates decrease 50 basis points

Q84: Changes in short term interest rates rarely

Q89: Retail passbook savings accounts are included as