Multiple Choice

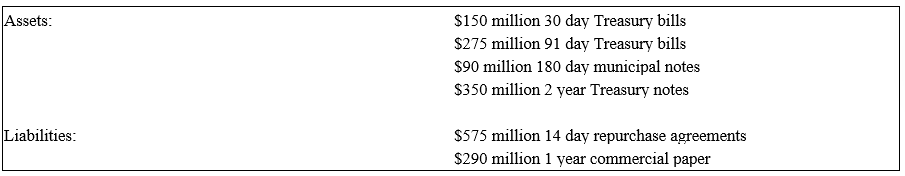

The following are the assets and liabilities of a government security dealer.

-Use the repricing model to determine the funding gap for a maturity bucket of 91 days.

A) -$60 million.

B) -$150 million.

C) $0.

D) -$250 million.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: The yield curve<br>A)relates rates for different maturities

Q23: When interest rates increase, banks are more

Q38: All FIs tend to mismatch the maturities

Q46: In general, the interest rate spread (spread

Q50: An assumption of the repricing model is

Q54: The spread effect demonstrates that, regardless of

Q57: Because the increased level of financial market

Q60: Which theory of term structure posits that

Q63: Which of the following statements is true?<br>A)An

Q114: Which of the following is a weakness