Multiple Choice

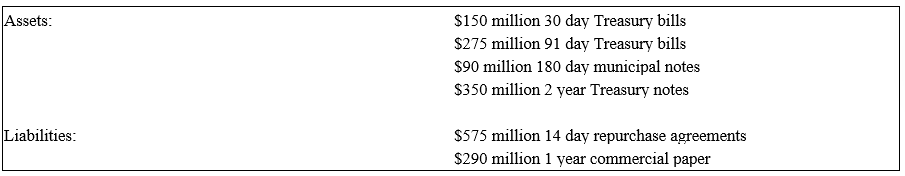

The following are the assets and liabilities of a government security dealer.

-Use the repricing model to determine the funding gap for a maturity bucket of 365 days.

A) +$15 million.

B) -$20 million.

C) -$350 million.

D) -$450 million.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: If the average maturity of assets is

Q6: One reason to include demand deposits when

Q20: The following information is from First Yaupon

Q22: The balance sheet of XYZ Bank appears

Q23: A positive gap implies that an increase

Q25: What is the change in the value

Q28: An FI finances a $250,000 2-year fixed-rate

Q29: If interest rates increase 75 basis points

Q57: A bank with a negative repricing (or

Q74: If interest rates decrease 50 basis points