Multiple Choice

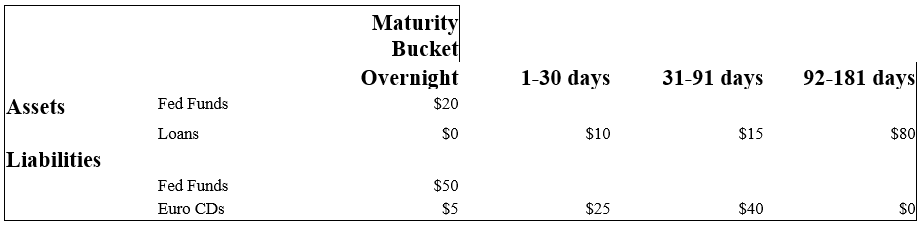

The following information details the current rate sensitivity report for Gotbucks Bank, Inc. ($ million) .

-Calculate the funding gap for Gotbucks Bank using (a) a 30 day maturity period and (b) a 91 day maturity period.

A) -$25 and +$80.

B) -$50 and -$75.

C) -$75 and +$5.

D) +$55 and -$40.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The Bank for International Settlements (BISs)requires depository

Q7: The liquidity premium theory of the term

Q8: The repricing model measures the impact of

Q10: Which theory of term structure states that

Q11: An interest rate increase<br>A)benefits the FI by

Q12: One reason to exclude NOW accounts when

Q40: The market value of a fixed-rate liability

Q41: To be more precise in measuring interest

Q65: Runoff in demand deposits in a repricing

Q99: Defining buckets of time over a range