Multiple Choice

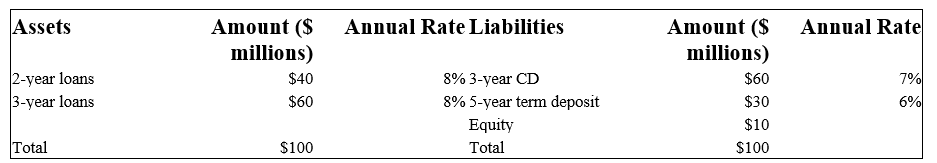

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.

-What is the weighted average maturity of the liabilities of the FI?

A) 3.67 years.

B) 3.30 years.

C) 3.00 years.

D) 5.00 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The market value of a fixed-rate liability

Q16: An FI's net interest income reflects<br>A)its asset-liability

Q22: For a given change in interest rates,

Q94: If the average maturity of assets is

Q114: The balance sheet of XYZ Bank appears

Q116: When the Fed finds it necessary to

Q117: If the chosen maturity buckets have a

Q118: Is the bank exposed to interest rate

Q122: What is spread effect?<br>A)Periodic cash flow of

Q123: Of the following institutions,which will be subject