Multiple Choice

Table 23.2

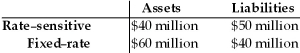

First National Bank

-Refer to Table 23.2.Assuming that the average duration of the bank's assets is four years,while the average duration of its liabilities is three years,a rise in interest rates from 5 percent to 10 percent will cause the net worth of First National to ________ by ________ of the total original asset value.

A) decline; 5%

B) decline; 1.3%

C) decline; 6.2%

D) increase; 5%

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Duration gap analysis<br>A) is a refinement of

Q48: To use the concept of duration to

Q49: If borrowers with the most risky investment

Q50: When banks offer borrowers smaller loans than

Q52: If a bank has more rate-sensitive liabilities

Q53: Credit rationing occurs when a bank<br>A) refuses

Q54: Table 23.1<br>First National Bank<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2777/.jpg" alt="Table

Q55: The difference between rate-sensitive liabilities and rate-sensitive

Q56: If First National Bank has a gap

Q102: In one sense _ appears surprising since