Essay

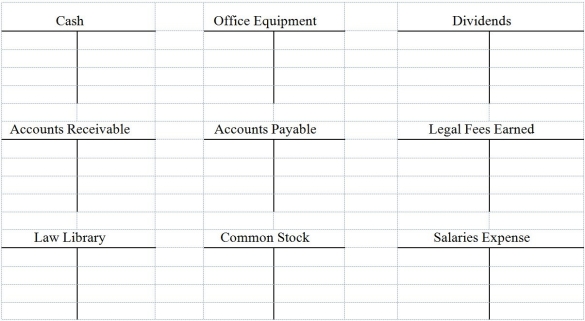

Mary Sunny began business as Sunny Law Firm on November 1. Record the following November transactions by making entries directly to the T-accounts provided. Then, prepare a trial balance, as of November 30.

a) Mary invested $15,000 cash and a law library valued at $6,000 in exchange for common stock.

b) Purchased $7,500 of office equipment from John Bronx on credit.

c) Completed legal work for a client and received $1,500 cash in full payment.

d) Paid John Bronx. $3,500 cash in partial settlement of the amount owed.

e) Completed $4,000 of legal work for a client on credit.

f) The firm paid $2,000 cash in dividends.

g) Received $2,500 cash as partial payment for the legal work completed for the client in (e).

h) Paid $2,500 cash for the legal secretary's salary.

Correct Answer:

Verified

Sunny Law Firm

Sunny Law Firm

Trial Balance

November 3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Trial Balance

November 3...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: In a double-entry accounting system, the total

Q32: Identify the statement below that is correct.<br>A)When

Q49: Which of the following statements is not

Q74: Which of the following is not a

Q97: Source documents identify and describe transactions and

Q121: A business's record of the increases and

Q137: The debt ratio helps to assess the

Q170: BBB Company sends a $2,500 invoice to

Q223: The posting process is the link between

Q233: A simple tool that is widely used