Multiple Choice

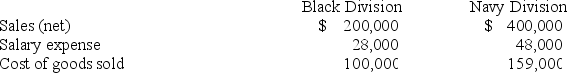

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

A) $52,000; $163,000.

B) $172,000; $352,000.

C) $72,000; $163,000.

D) $72,000; $193,000.

E) $100,000; $241,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The salaries of employees who spend all

Q21: What is an investment center and how

Q23: Investment center managers are usually evaluated using

Q37: A company pays $15,000 per period to

Q84: Using the information below, compute the

Q85: Wren Pork Company uses the value

Q86: A granary allocates the cost of

Q114: The difference between a profit center and

Q151: Allocating costs to service departments involves accumulating

Q200: A retail store has three departments,A,B,and C,each