Essay

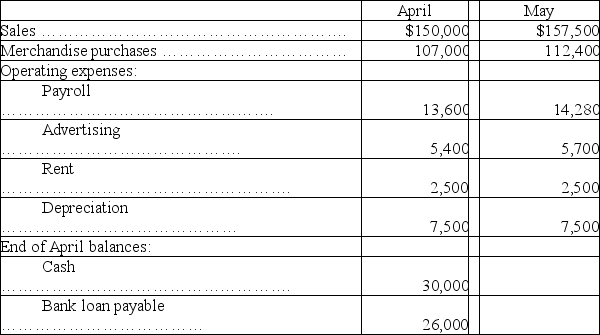

Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Additional data:

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $25,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The _ shows the budgeted costs for

Q47: What is a merchandise purchases budget? How

Q61: A cash budget shows the expected cash

Q87: Which of the following budgets is not

Q93: A plan that reports the units or

Q111: Budgets are long-term financial plans that generally

Q122: Long-term liability data for the budgeted balance

Q159: Bengal Co. provides the following sales forecast

Q192: Operating budgets include all the following budgets

Q202: A sporting goods store budgeted August purchases