Essay

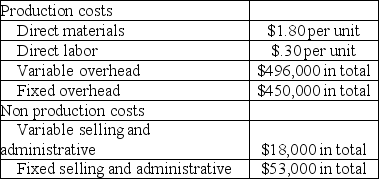

Stonehenge Inc., a manufacturer of landscaping blocks, began operations on April 1 of the current year. During this time, the company produced 750,000 units and sold 720,000 units at a sales price of $9 per unit. Cost information for this period is shown in the following table:

a. Prepare Stonehenge's December 31st income statement for the current year under absorption costing.

a. Prepare Stonehenge's December 31st income statement for the current year under absorption costing.

b. Prepare Stonehenge's December 31st income statement for the current year under variable costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Front Company had net income of $72,500

Q60: Reliance Corporation sold 4,000 units of its

Q89: _ costing is the only acceptable basis

Q113: When units produced equal units sold,reported income

Q141: Under absorption costing, a company had the

Q144: Heather, Incorporated reports the following annual cost

Q147: Mentor Corp. has provided the following information

Q148: Wind Fall, a manufacturer of leaf blowers,

Q149: Given the following data, calculate the total

Q150: Alexis Co. reported the following information for