Essay

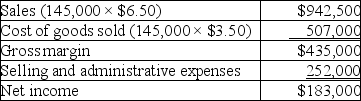

Chilly Chips, Inc., a producer of ice cream, began operations this year. During this year, the company produced 160,000 cartons of ice cream and sold 145,000. At year-end, the company reported the following income statement using absorption costing:

Production costs per carton total $3.50, which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 16,000 units produced). Sixty percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per carton total $3.50, which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 16,000 units produced). Sixty percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Correct Answer:

Verified

Income under absorption costing = Income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: A company is currently operating at 60%

Q25: Given the following data, calculate the total

Q27: Fields Cutlery, a manufacturer of gourmet knife

Q29: 32 Degrees, Inc., a manufacturer of frozen

Q31: Sea Company reports the following information regarding

Q32: Under absorption costing, a company had the

Q33: Given the following data, total product cost

Q74: The biggest problems with producing too much

Q105: Since fixed costs remain constant in the

Q150: The traditional income statement format used for