Essay

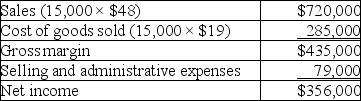

Anchovy, Inc., a producer of frozen pizzas, began operations this year. During this year, the company produced 16,000 cases of pizza and sold 15,000. At year-end, the company reported the following income statement using absorption costing:

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Correct Answer:

Verified

Income under absorption costing = Income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: _ and _ are product costs that

Q15: Given the Scavenger Company data,what is net

Q27: Chance,Inc.sold 3,000 units of its product at

Q46: How will net income under variable costing

Q51: A company reports the following information regarding

Q53: Lukin Corporation reports the following first year

Q56: Maloney Co. provided the following information for

Q59: Blackbird, Incorporated reports the following information regarding

Q60: Assume a company had the following production

Q182: Given Advanced Company's data,compute cost per unit