Multiple Choice

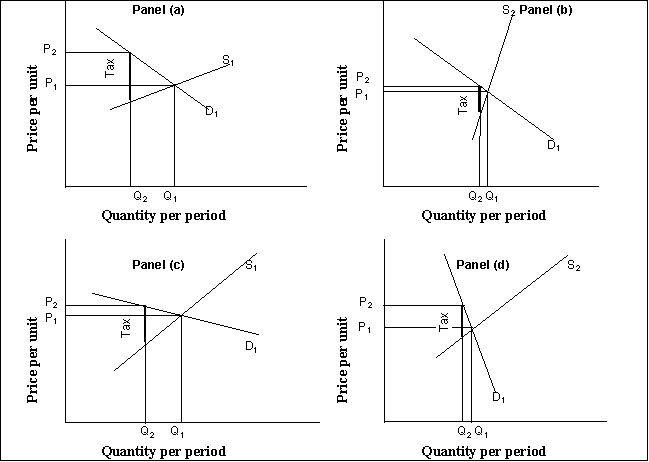

Use the following to answer question(s) : Tax Incidence

-(Exhibit: Tax Incidence) All other things unchanged, when a good or service is characterized by a relatively elastic supply, as shown in Panel _______ , the greater share of the burden of an excise tax imposed on it (shown by the tax wedge in each panel) is borne by _______.

A) (a) ; buyers

B) (b) ; sellers

C) (b) ; buyers

D) (a) ; sellers

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Annual taxes paid on a home would

Q16: Public choice theory _ the notion that

Q17: Use the following to answer question(s): Correcting

Q18: Firms that supply a good in an

Q19: Determining whether the burden of taxes falls

Q21: The ability-to-pay principle suggests that the amount

Q22: A public good is one for which:<br>A)

Q23: The vice president of an advertising agency

Q24: The evidence in the U.S.economy suggests that,

Q25: Although the sales tax is levied proportionately,