Essay

Milton Company makes t-shirts.The shirts move through two departments during the production process.First,fabric is cut in the Cutting Department.The fabric pieces are then transferred to the Sewing Department where the shirts are assembled.The shirts are then sold to retail chains such as Wal-Mart and K-Mart.The following transactions apply to the company's operations during the current accounting period,which is its first year of operations,2014:

(a)Issued stock to shareholders for cash,$90,000.

(b)Purchased $30,000 of direct raw materials.

(c)Direct materials issued to the cutting and sewing departments,$10,000 and $2,000,respectively.

(d)Paid labor cost of $24,400.Direct labor usage for the cutting and assembly departments was $14,000 and $8,000,respectively.Indirect labor costs amounted to $2,400.

(e)Paid other overhead costs,$4,000.

(f)Applied overhead to production in both departments using the predetermined overhead rate of $0.30 per direct labor dollar.

(g)Transferred $21,000 of inventory from the Cutting Department to the Sewing Department.

(h)Transferred $30,400 of inventory from the Sewing Department to Finished Goods.

(i)Sold inventory costing $16,000 for $25,000 cash.

(j)Paid selling and administrative expenses,$5,000.

(k)Disposed of any underapplied or over-or-under-applied overhead.

Assume that all transactions are for cash unless otherwise stated.

Required:

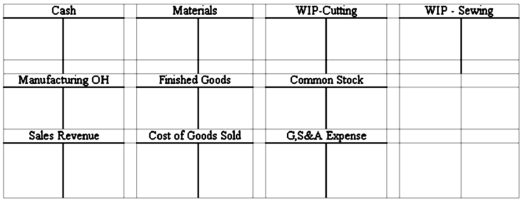

1)Record the transactions in the T-accounts provided.

2)Prepare a schedule of cost of goods manufactured and sold.

3)Compute the amount of gross margin that will be reported on the firm's year-end income statement.

Correct Answer:

Verified

Answers will vary

Feedback: 1)Posted T-a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Feedback: 1)Posted T-a...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Factory insurance is an indirect product cost

Q52: Indicate whether each of the following statements

Q120: Bruce Company experienced an event that

Q121: In a job-order cost system,as goods are

Q122: Wetzel Manufacturing Company has two departments,assembly

Q123: Bacon Manufacturing Company has two departments,Assembly

Q124: Which of the following is not a

Q127: The entry to record cost of selling

Q129: Select the incorrect statement regarding the recognition

Q130: Mertz Group is a consulting firm specializing