Essay

Redmond Manufacturing Company began operations on January 1.The Company was affected by the following events during its first year of operation:

a)Company issued stock to owners for $100,000 cash.

b)Purchased materials,$8,000 for cash.

c)Transferred $4,000 of direct materials to production (Job #1: $3,000;Job #2: $1,000).

d)Paid direct labor costs,$5,000 (Job #1: $2,500;Job #2: $2,500).

e)Paid $3,000 cash for various actual overhead costs.

f)Allocated overhead to work in process at 60% of direct labor cost.

g)Completed Job #1 and transferred it to Finished Goods.

h)Sold Job #1 for $8,400 cash.

i)Paid $200 cash for selling and administrative expenses.

Required:

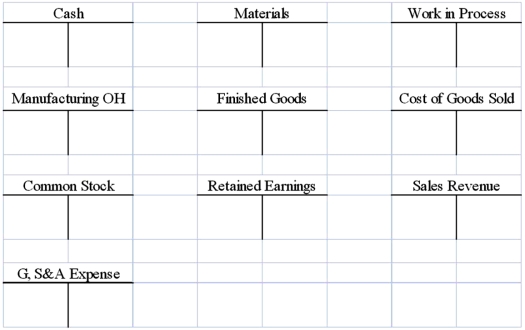

1)Record the above events in the T-accounts provided.Label your transactions (a)- (i).

2)Determine the ending balance in the work in process account.

3)Prepare a schedule of cost of goods manufactured and sold.

4)Compute the amount of gross profit earned on Job #1.

Correct Answer:

Verified

Answers will vary

1)Posted T-accounts:  ...

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

1)Posted T-accounts:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Company X manufactures 3-ring notebooks.All of the

Q93: Orlando Company paid $100 cash to

Q100: Pinkston Company completed 12,000 units of product

Q101: Ferguson Company recognized $400 of estimated

Q102: For a manufacturing business,cost of indirect materials

Q131: Hutton Company reported a $750 unfavorable overhead

Q132: Which of the following is a valid

Q145: Paying for factory utilities used during the

Q146: During February,Benke Manufacturing Company paid $18,000 in

Q149: The credit to the Finished Goods Inventory