Multiple Choice

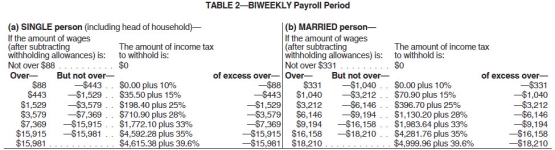

Warren is a married employee with six withholding allowances.During the most recent biweekly pay period,he earned $9,450.00.Using the percentage method,compute Warren's Federal income tax.(Do not round interim calculations,only round final answer to two decimal points.)

A) $2,490.15

B) $2,156.90

C) $1,796.94

D) $1,602.25

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following payment methods is

Q17: Renee is a salaried exempt employee who

Q22: Social Security tax has a wage base,

Q36: A firm has headquarters in Indiana,but has

Q42: Collin is a full-time exempt employee

Q49: Which of the following deductions cannot be

Q50: Retirement fund contributions are considered Pre-Tax Deductions

Q52: Which of the following guidelines does the

Q58: A retirement plan that allows employees to

Q68: Two classes of deductions exist: pre-tax and