Multiple Choice

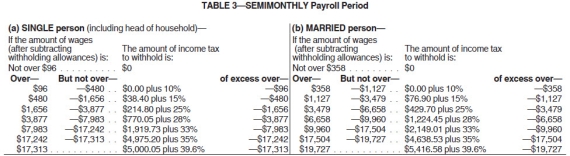

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the Federal income tax and the wage-bracket table for the state income tax.Do not round interim calculations,only round final answer to two decimal points.)

A) $2,351.71

B) $2,503.95

C) $2,829.35

D) $2,478.90

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Charitable contributions are an example of post-tax

Q30: Federal income tax,Medicare tax,and Social Security tax

Q32: Maile is a full-time exempt employee who

Q34: Janna is a salaried nonexempt employee who

Q35: Which of the following may be included

Q35: Wyatt is a full-time exempt music engineer

Q40: From the employer's perspective,which of the following

Q41: Health Savings Accounts may not be used

Q42: Collin is a full-time exempt employee

Q43: The percentage of the Medicare tax withholding