Multiple Choice

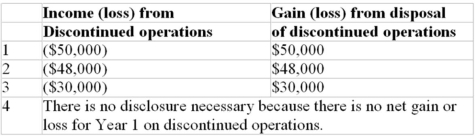

Jacks Corporation decided to sell its playing card business segment for $600,000,on September 1,Year 1.The disposal date is November 1,Year 1.The book value of the segment's net assets is $550,000.The pre-tax income for the segment for the period January 1 - September 1,Year 1,was a loss of $80,000; the pre-tax income for the segment for September and October was $30,000.Assuming a tax rate of 40%,choose the correct reporting for discontinued operations in the income statement of Jacks Corporation,for the year ended December 31,Year 1.

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A company had 70,000 shares of common

Q5: Given the following amounts from an income

Q6: The following information has been obtained from

Q8: Which of the following is true about

Q11: Increases in the recoverable value of a

Q22: On January 1, 2009, a corporation purchased

Q60: The concept of intra-period tax allocation is

Q62: Once an asset has been designated as

Q74: After an asset held for sale has

Q83: Other comprehensive income includes unrealized gains and