Multiple Choice

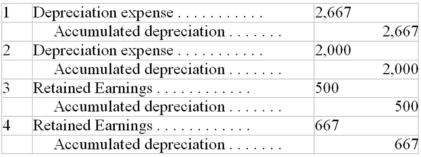

A company owns an operational asset acquired on January 1,2006 at a cost of $10,000.It had an estimated useful life of 5 years,no residual value,and was being depreciated on a straight-line basis.On December 31,2007,it was determined that the total useful life would be 4 years.The following adjusting entry (assuming no adjusting entries have been made) for the accounting year ended December 31,2007 should be made (rounded to the nearest dollar) :

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Correct Answer:

Verified

Q24: If an abandoned asset's recoverable value increases

Q40: The following data are available for 2001

Q47: Interperiod income tax allocation:<br>A)Involves the allocation of

Q48: A company provides residential carpet cleaning at

Q49: Sierra Inc.committed to sell its mountaineering

Q50: Queen Corporation decided to sell its

Q95: In the current year, a firm has

Q101: The financial results of a discontinued segment

Q124: A company had 20,000 shares of common

Q132: On December 31, 2007, a company discovered