Multiple Choice

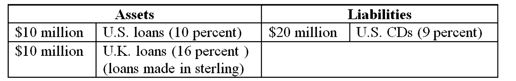

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-If the spot foreign exchange rate remains constant at $1.60 to ≤1 throughout the year, the return from the U.K. investment will be

A) 15%.

B) 12%.

C) 16%.

D) 13%.

E) 7%.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: To a U.S.trader of foreign currencies, a

Q24: Which of the following is an example

Q42: An FI has purchased (borrowed) a one-year

Q44: The following are the net currency

Q45: The one-year CD rates for financial institutions

Q46: Yen Bank wishes to invest in Yen

Q49: Average daily turnover in the FX market

Q50: A negative net exposure position in FX

Q51: Assume that instead of investing in Euro

Q72: As the U.S.dollar appreciates against the Japanese