Multiple Choice

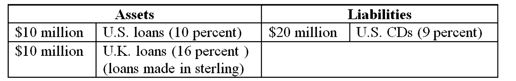

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-The weighted return on the bank's portfolio of investments would be

A) 15%.

B) 12%.

C) 16%.

D) 13%.

E) 7%.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: U.S.life insurance companies generally hold less than

Q17: A positive net exposure position in FX

Q27: The greater the volatility of foreign exchange

Q33: The market in which foreign currency is

Q48: Interest rate parity implies that the discounted

Q86: The underlying cause of foreign exchange volatility

Q90: How would you characterize the FI's risk

Q92: The exposure to foreign exchange risk by

Q93: At what one-year forward rate will the

Q94: As of 2012, which of the following