Multiple Choice

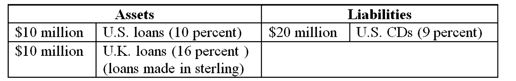

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-If the exchange rate had fallen from $1.60/≤1 at the beginning of the year to $1.50/≤1 at the end of the year when the FI needed to repatriate the principal and interest on the loan. What would be the dollar loan amount repatriated at the end of the year?

A) $6.25 million.

B) $11.6 million.

C) $7.25 million.

D) $6.625 million.

E) $10.875 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: When purchasing and selling foreign currencies to

Q46: The FX markets of the world have

Q64: Which of the following is NOT a

Q74: As of March 2012, U.S. banks were

Q75: What is the portfolio weight of the

Q77: During the late 2000's financial crisis, global

Q79: Assume that instead of investing in Euro

Q80: In which of the following FX trading

Q80: The real interest rate reflects the underlying

Q81: U.S. pension funds hold approximately _ of