Multiple Choice

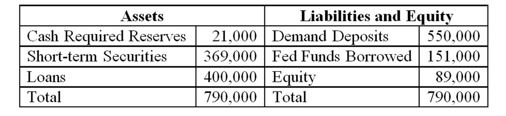

-If the bank's expected net deposit drain is +4 percent, what is the bank's expected liquidity requirement?

A) $7,560.

B) $6,040.

C) $16,000.

D) $22,000.

E) $14,760.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: An open-end bond mutual fund is holding

Q10: If stored liquidity is used by a

Q14: The net stable funds ratio (NSFR) is

Q51: Asset-side liquidity risk may be a result

Q56: It is impossible for money market mutual

Q67: Liquidity planning primarily is designed to assist

Q80: Banks with relatively high loan commitments face

Q91: The assets of PC insurers are relatively

Q95: When liquidity risk problems occur at a

Q97: Depository institutions generally rely on each other