Multiple Choice

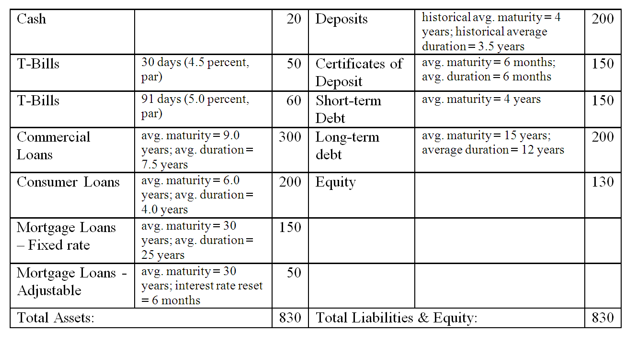

-What is this bank's interest rate risk exposure, if any?

A) The bank is exposed to decreasing interest rates because it has a negative duration gap of -0.21 years.

B) The bank is exposed to increasing interest rates because it has a negative duration gap of -0.21 years.

C) The bank is exposed to increasing interest rates because it has a positive duration gap of +0.21 years.

D) The bank is exposed to decreasing interest rates because it has a positive duration gap of +0.21 years.

E) The bank is not exposed to interest rate changes since it is running a matched book.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Duration increases with the maturity of a

Q23: Perfect matching of the maturities of the

Q26: The economic meaning of duration is the

Q28: Managers can achieve the results of duration

Q75: Larger coupon payments on a fixed-income asset

Q76: For a given maturity fixed-income asset, duration

Q86: What is the effect of a 100

Q90: <span class="ql-formula" data-value="D = \frac { \left[

Q93: <span class="ql-formula" data-value="\begin{array} { | l |

Q97: Setting the duration of the assets higher