Multiple Choice

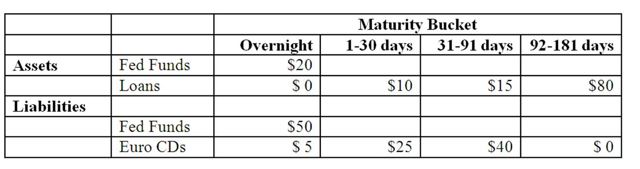

The following information details the current rate sensitivity report for Gotbucks Bank, Inc. ($million) .

-What does Gotbucks Bank's 91-day gap positions reveal about the bank management's interest rate forecasts and the bank's interest rate risk exposure?

A) The bank is exposed to interest rate decreases and positioned to gain when interest rates decline.

B) The bank is exposed to interest rate increases and positioned to gain when interest rates decline.

C) The bank is exposed to interest rate increases and positioned to gain when interest rates increase.

D) The bank is exposed to interest rate decreases and positioned to gain when interest rates increase.

E) Insufficient information.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The market value of a fixed-rate liability

Q48: Because of its complexity, small depository institutions

Q65: Runoff in demand deposits in a repricing

Q81: <span class="ql-formula" data-value="\begin{array} { | l |

Q82: The repricing model is based on an

Q82: The repricing gap model is a book

Q83: The net worth of a bank is

Q85: Which theory of term structure states that

Q88: The liquidity premium theory of the term

Q91: <span class="ql-formula" data-value="\begin{array} { | l |