Multiple Choice

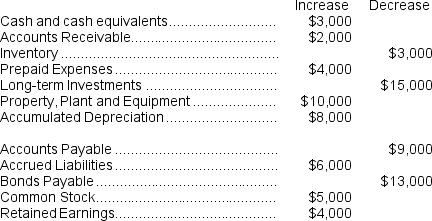

(Appendix 14A) The change in each of Kendall Corporation's balance sheet accounts last year follows:

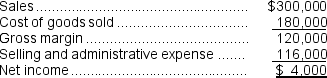

Kendall Corporation's income statement for the year was:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

-The selling and administrative expense adjusted to a cash basis would be:

A) $120,000

B) $106,000

C) $110,000

D) $112,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: (Appendix 14A) The changes in Northrup Corporation's

Q2: (Appendix 14A) The most recent balance sheet

Q3: The changes in each balance sheet

Q6: Wister Corporation had sales of $462,000 for

Q7: (Appendix 14A) The most recent balance sheet

Q9: (Appendix 14A) Van Beeber Corporation's comparative balance

Q10: (Appendix 14A) Kilduff Corporation's balance sheet and

Q11: (Appendix 14A) The changes in Northrup Corporation's

Q13: Cridberg Corporation's selling and administrative expenses for

Q25: Evita Corporation prepares its statement of cash